HCMC’s condo supply likely to bottom out

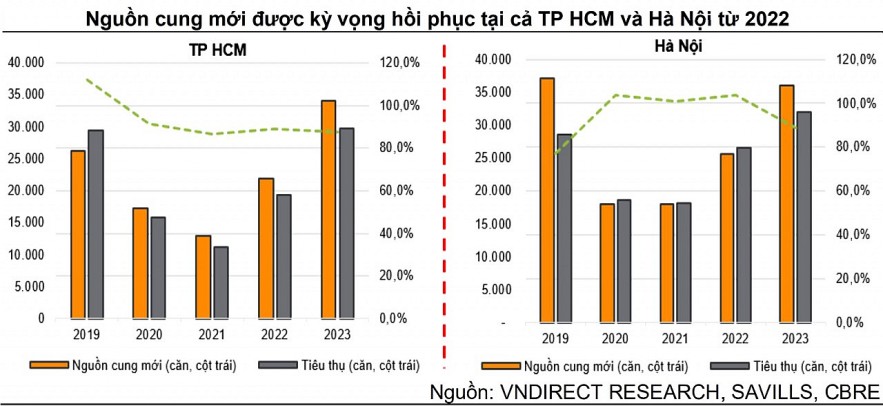

We expect HCMC new condo supply to bottom out in 2021 and recover strongly by 60-70% in 2022-23, on the back of loosening regulatory measures such as Decree 148 and Amended Construction Law 2020. We believe suburb housing market in HCMC namely Binh Chanh, Can Gio, Nha Be, Thu Duc will be in spotlight in 2022, driven by the infrastructure development in these areas.

We remain optimistic in 2022 outlook for housing market in HCMC’s neighboring provinces, which we expect to experience both demand volume and price expansion. After the work-from-home experience during the pandemic, we believe homebuyers can prefer for larger-sized landed homes to meet ‘work live-play’ ecosystem demand. In the context of strong price escalation along with limited supply in HCMC since 2018 and acceleration in infrastructure development shortening the time to HCMC, we see opportunities for HCMC’s neighboring provinces such as Long An and Dong Nai.

Northern residential market: flourish supply in both condo and landed property

We expect to see a 40% increase in Hanoi new condo supply in 2022 to 25,600 units, then in 2023 with 36,100 units, dominated mostly by units in the west and the east of Hanoi. Take up rate is likely to improve by 90%-110% in 2022-2023, higher than the rate of 75%-90% seen in 2018-2019, equivalent to 27,000-32,000 sold units per year. We see the new supply of landed property market will continue depend on launches of townships in 2022. According to CBRE, new supply is likely to plunge 40% to 1,500 units in 2022 due to the lack of Vinhomes’ massive project. The market is expected to welcome new products from new mega townships such as Vinhomes Wonder Park, Vinhomes Co Loa and launches of next phases from townships such as Eco Park, Gamuda City.

We see landed property markets at Hanoi’s neighboring provinces that enjoy convenient connection to Hanoi CBD, such as Hung Yen are likely in the spotlight in 2022. Vinhomes also plans to launch a 460ha mega township in Hung Yen in 2022. We consider Hung Yen as one of Northern emerging property markets, along with Bac Ninh and Quang Ninh. This province is situated at the heart of the Northern Delta, having favorable connection to Hanoi, Hai Phong and Nam Dinh. According to CBRE, in 2020, selling prices for landed property in Hung Yen rose 12%, higher than the Hanoi average rate of 7.6%. New landed supply in Hung Yen could reach 2,500 units in 2021, 16.8% higher than that of Hanoi, mostly from mega township projects. We believe these projects will achieve a take-up rate of 70-80% in 2021, driven by high demand from experts, engineers and workers in this area.

Strong housing demand leading to robust prices growth

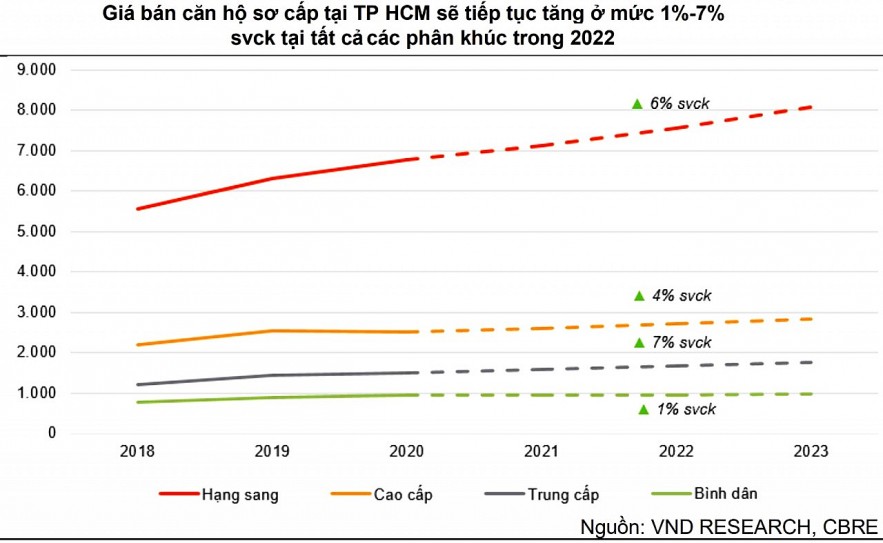

We believe there will be no announcements of discounts in HCMC housing primary prices in 2022 to factor in the increase in development cost with higher compensation cost and financing cost due to pending in the past three years and material expense escalation. We expect developers will offer better handover conditions, better facilities and supporting payment terms to stimulate demand rather than decrease their primary prices. Follow these points, we expect condo primary prices in HCMC will continue to increase in all segments at 1-7%. We project mid-end segment will increase the most at 7% fueled by its strong demand and limited supply. The luxury segment likely continues to be more excited in 2022 by the launches of projects having sought-after locations in District 1 and Thu Duc City, after a new pricing level of US$16,500-18,000 set by a new branded residence project in District 1 in 2021.

Besides, landed prices of suburb in HCMC likely continue to rise impressively in 2022 on the expansion of expressway to the west and coastal areas in the south with imminent infrastructure projects such as Ben Luc – Long Thanh, Dau Giay – Phan Thiet, Long Thanh international airport phase 1. The proposal on establishment of Northwest City consisting of Cu Chi and Hoc Mon coupled with process planning for urbanizing Cu Chi, Hoc Mon, Binh Chanh, Nha Be, Can Gio into urban districts should boost land prices in these areas as well.

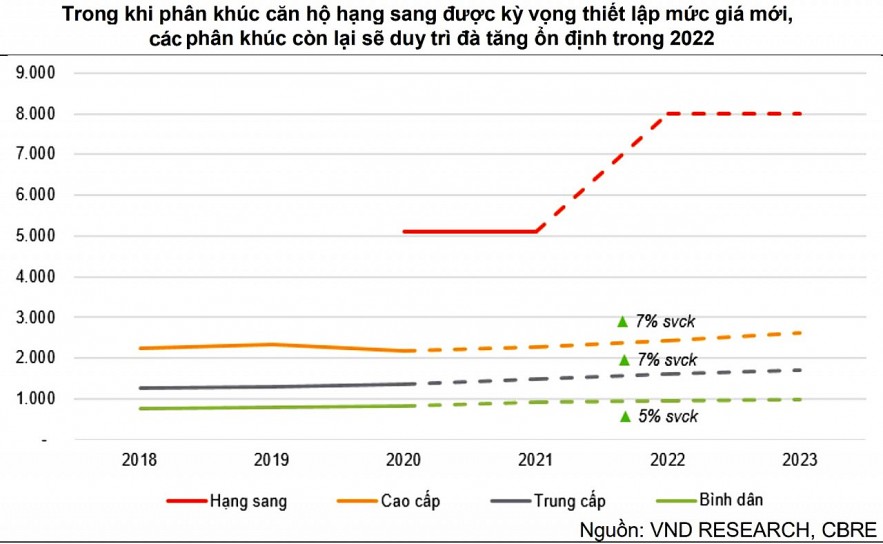

Meanwhile we expect to see new pricing levels in the luxury segment set by the Masterise’s project in Hang Bai with a price, based on industry estimates, of US$8,000-10,000. For landed market, we believe landed prices of suburb in Hanoi will continue to be in an upward trend in 2022 thanks to infrastructure development, especially the launch of Cat Linh, Ha Dong metro line in Nov 2021 should boost land prices in its surrounding areas such as Ha Dong, Dong Da.

Sourced by VND Research, CBRE