Credit increased sharply after the economy reopened, many banks showed signs of "running out of" credit lines assigned for the first time. Analysts predict that the SBV will have a credit room loosening in the middle of the third quarter of this year, which is expected to be a "springboard" to help the real estate market in 2022 make a strong breakthrough.

Current status of credit room in the real estate sector

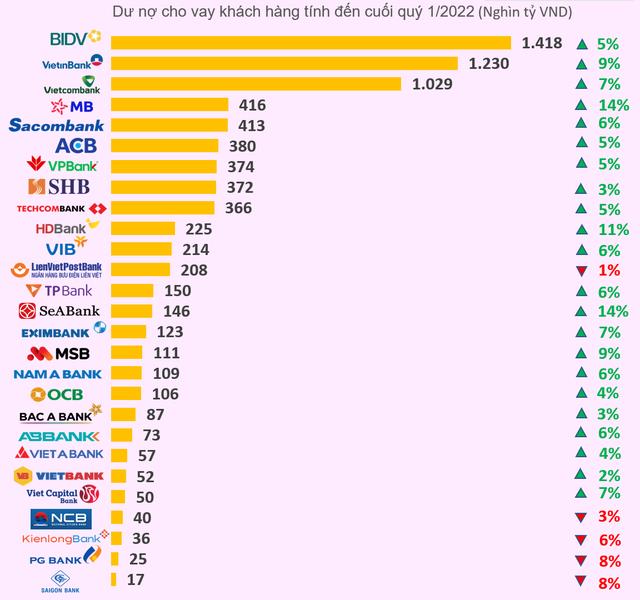

According to the State Bank of Vietnam (SBV), credit growth by the end of the first quarter of 2022 reached 5.04%, 2.3 times higher than the same period last year. Many banks have almost "emptied out" the credit growth assigned for the first time.

Specifically, according to the share of the Chairman of Vietcombank, by April 29, the bank's credit growth had reached 8.8%. Compared to the first-time granted credit room of 10%, Vietcombank has used up most of it. Or according to Bao Viet Securities (BVSC), MB also hit credit growth of 14.8% in the first quarter. This growth has also touched MB's first provisional credit of 15% and is waiting. Approve a new credit line.

The first quarter of 2022 recorded an unprecedentedly high credit growth rate at banks.

The first quarter of 2022 recorded an unprecedentedly high credit growth rate at banks.

By the end of March and the beginning of April, a number of banks such as Techcombank and Sacombank announced to suspend disbursement of real estate loans. The temporarily granted credit limit in 2022 is not large, so this bank will prioritize groups such as agriculture, export, supporting industries...

It can be seen that in recent years, credit growth limits of banks have been granted quite cautiously. Credit room will be provided quarterly by the State Bank, when most banks will have to apply for more and wait for approval to balance loans.

In particular, the real estate sector is not a priority sector and the lending growth of this sector is also gradually cooling down. In 2018, the real estate credit loan rate was 26%, by 2020 it will decrease to 12% and will be maintained in 2021. Currently, real estate credit currently accounts for about 18-20% of the total outstanding loans of the economy. Those signs show that the market has reached the peak of hot growth.

Expecting to loosen room in the middle of the third quarter of 2022, real estate flourishes

Through a meeting on the results of monetary policy management and banking activities in the first 6 months of 2022, the State Bank (SBV) said that credit increased by 8.15% compared to the end of 2021, equivalent to up 17.1% over the same period, as of June 9, 2022.

The growth rate over the same period is much higher than the average 12-14% maintained since 2018 and the SBV also shows a somewhat more cautious attitude in operating monetary policy when risks to The economy is still big in the near future.

Therefore, the State Bank emphasized that it will grant more credit lines at a more reasonable time (probably in the middle of the third quarter of 2022 as SSI expects) and the adjustment will depend on the financial health of each bank. As a result, deposit interest rates will no longer face much upward pressure as in recent times.

Credit growth by month (% over the same period). Source: SSI

Credit growth by month (% over the same period). Source: SSI

This will be a positive signal for the strong growth of the real estate market in the coming time.

By Nhip song kinh te